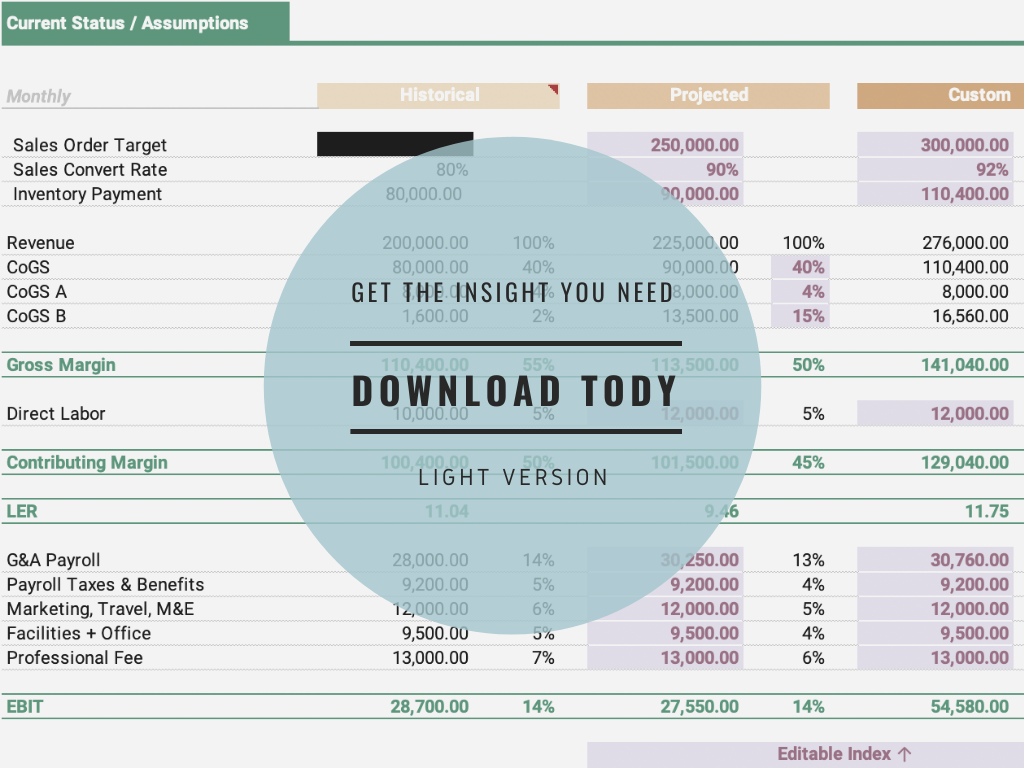

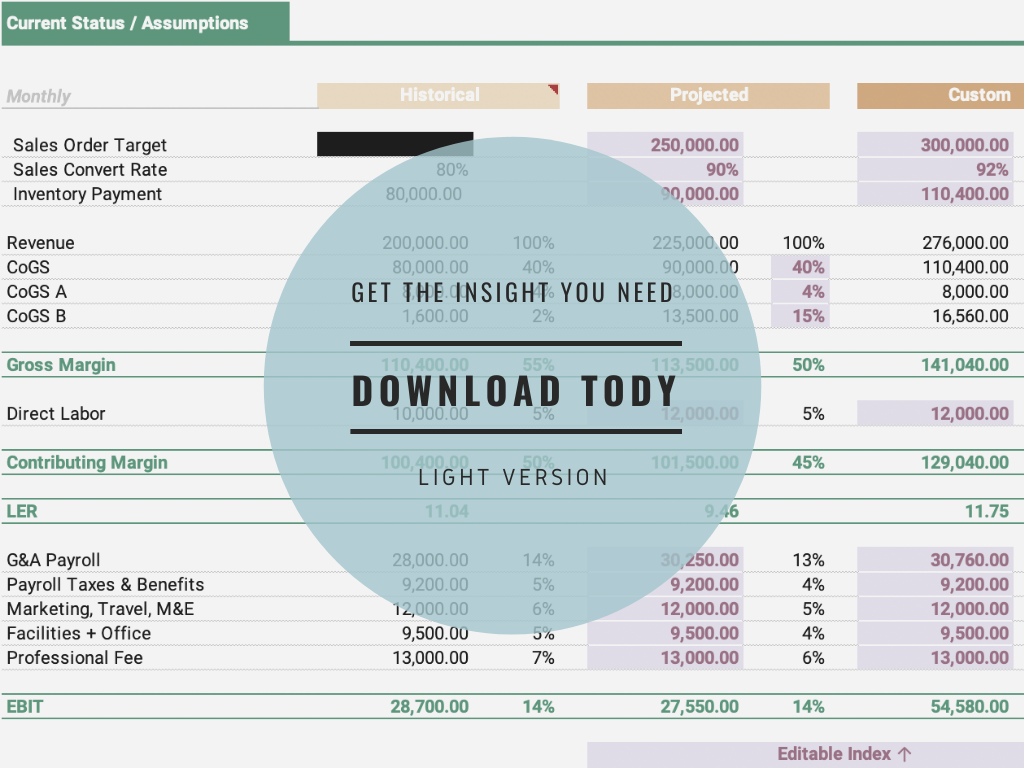

Unlike budgeting, the cash forecasting model is an ever-changing model that needs to be maintained. We put all the assumptions we’ve already known and laid it out to see where we’ll land in the next 30, 60, or 90 days.

A budget is just an excuse to spend money. As an alternative, the cash forecasting model provides you the assumptions as of today and helps you predict the future. If you are interested in learning more, MEASURE x HACK’s cash management lesson covers the primary differences, what cash forecasting does, and what stories it tell you.

The frequency you look at a number should give you enough time to influence that number before you see it again. With that said, we’d recommend entrepreneurs look at their financial forecasts at least once 2-week, but preferably once a month. This would give you enough time to make changes but not so frequently to distract you from what’s more important. Also, make sure you take a look at it for any strategic planning.

Your accountant/controllers/CFO probably are the ones who maintain your cash forecasting model. However, not exactly. A good cash forecasting model needs to take all the assumptions and laid it out to see where you’ll land in the future. Thus, it requires different departments’ joint efforts since the majority data source will come from each department.

CHOOSE YOUR PLAN

CHECK-OUT

RECEIVE

*No financial background needed

Recurring

*Recommended for financial specialist

Unlike budgeting, the cash forecasting model is an ever-changing model that needs to be maintained. We put all the assumptions we’ve already known and laid it out to see where we’ll land in the next 30, 60, or 90 days.

A budget is just an excuse to spend money. As an alternative, the cash forecasting model provides you the assumptions as of today and helps you predict the future. In this lesson, we’ll go over the primary differences, what cash forecasting does, and what stories it tell you.

The frequency you look at a number should give you enough time to influence that number before you see it again. With that said, we’d recommend entrepreneurs look at their financial forecasts at least once 2-week, but preferably once a month. This would give you enough time to make changes but not so frequently to distract you from what’s more important. Also, make sure you take a look at it for any strategic planning.

Your accountant/controllers/CFO probably are the ones who maintain your cash forecasting model. However, not exactly. A good cash forecasting model needs to take all the assumptions and laid it out to see where you’ll land in the future. Thus, it requires different departments’ joint efforts since the majority data source will come from each department.

Cash forecasting predicts cash flow within the next 30, 60, and 90 days unique to your business. You know what you’re heading into and can make changes swiftly to influence your cash outcome.

CHOOSE YOUR PLAN

CHECK-OUT

RECEIVE

*No financial background needed

Recurring

*Recommended for financial specialist